The latest approval of Biogen’s Alzheimer’s Illness (AD) drug Aduhelm (aducanumab) has signaled a seismic shift within the AD area.

Previous to the go forward from the regulators, no remedy that sought to deal with the underlying causes of the notoriously troublesome to deal with memory-wiping situation had ever been authorized.

Nevertheless, following a damaging AdCom and given slim possibilities of making the grade, the approval was extremely controversial and despatched shock waves throughout Wall Avenue.

Nonetheless, it’s considerably of a recreation changer for firms working within the area; Whereas the approval is nice information for AD sufferers, it might presumably open the floodgates for different firms looking for treatments to struggle AD. And this can even open up additional alternatives for traders.

Maxim’s Jason McCarthy says aducanumab’s approval, the flurry of exercise within the area and rising curiosity deserves a “recalibration” of promising AD gamers’ valuations.

“Choose one aspect or the opposite,” the 5-star analyst stated, referring to the Biogen controversy, “We need to step again and now have a look at the AD area and the way the approval of aducanumab thrusts an area that was as soon as left for lifeless, into what may very well be a brand new golden age.”

With all this as backdrop, McCarthy has reassessed three names working throughout the area with every providing an AD-targeting drug with “one thing distinctive, but in addition one thing in frequent across the concentrating on of neuroinflammation.” Extra information is on the way in which for every title as properly, which might additional catapult the share worth increased over the approaching months.

We delved into the TipRanks database to get the lowdown on McCarthy’s picks. The info reveals all are Purchase-rated and supply robust upside potential from present ranges. Let’s take a more in-depth look.

Cassava Sciences (SAVA)

We’ll begin off with an Alzheimer-focused firm turning lots of heads this yr. Cassava Sciences is a neuroscience-focused clinical-stage biotech firm, whose lead AD candidate simufilam boasts a unique method to fixing the AD puzzle. As an alternative of making an attempt to clear amyloid out of the mind which has been the frequent theme to AD therapies, it targets the stabilization of altered filamin A (FLNA), a scaffolding protein.

Simufilam’s progress has gone swimmingly up to now. Earlier this yr, interim information from a Section 2 open-label research confirmed that after 6 months of remedy, the drug improved cognitive capabilities and sufferers’ behaviour.

Later this month (July 26-Twenty ninth), Cassava will current the info of a nine-month interim evaluation on the 2021 Alzheimer’s Affiliation Worldwide Convention (AAIC). As Cassava’s remedy is also the primary to show cognitive advantages at 9 months, optimistic outcomes may very well be one thing of a recreation changer, and McCarthy has excessive hopes forward of the readout.

“Expectations on this information readout are constructing and provided that it is just 3 months on high of the primary 6-month information set, we consider the likelihood that the cognition modifications keep related or at the least above the stabilization threshold, ought to favor sumifilam,” the 5-star analyst stated. “If the info keep inside this vary, SAVA shares might considerably rise in worth. Whereas a lot of the main target is on this readout, notice that there are extra information units to return in addition to the P2b open-label extension program, which is enrolling as much as n=150 sufferers.”

These information units embody a readout following 12 months of remedy, which must be introduced in September. There are additionally the initiations of two simufilam Section 3 trials in 2H21 to look ahead to.

SAVA shares have been on an almighty tear in 2020 because of the positivity surrounding simufilam, however with the aforementioned catalysts, ~$275 million in money to fund the late-stage trials, McCarthy says it’s “affordable to imagine that SAVA shares, regardless of the fast rise in 2021, stay undervalued.”

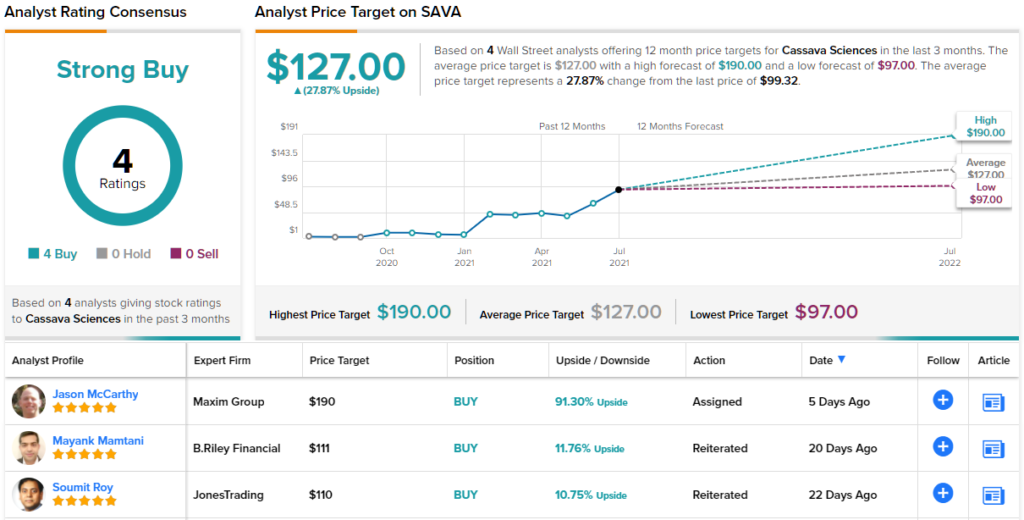

As such, McCarthy charges SAVA shares a Purchase together with a $190 worth goal. Traders may very well be sitting on positive aspects of 91%, ought to McCarthy’s forecast play out over the approaching months. (To look at McCarthy’s monitor document, click on right here)

McCarthy’s colleagues wholeheartedly agree on this one. With 3 further Buys, the inventory boasts a Robust Purchase consensus ranking. The common worth goal is extra modest than the Maxim analyst’s, but at $127, nonetheless suggests shares will acquire one other 33% within the yr forward. (See SAVA inventory evaluation on TipRanks)

INmune Bio Inc (INMB)

Subsequent on McCarthy’s checklist of promising AD performs is INmune Bio, a small-cap clinical-stage biotech centered on immunotherapies. The corporate’s pipeline contains potential therapies for most cancers, NASH (nonalcoholic steatohepatitis), and a drug already in Section 2 testing for the remedy of problems of cytokine storm in sufferers with Covid-19.

Of curiosity right here is INmune’s AD candidate, XPro1595, which is at present in Section 1 testing.

XPro1595 is a PEGylated protein that targets soluble tumor necrosis issue (sTNF), an inflammatory cytokine famous at increased ranges within the cerebrospinal fluid (CSF) and mind (autopsy) of victims of Alzheimer’s illness and different neurodegenerative problems.

The drug goals to neutralize soluble TNF with out influencing trans-membrane TNF (tmTNF) or TNF receptors, its mechanism permitting for extra exact concentrating on.

In January, INmune launched information from the section 1b research which confirmed that following three months of remedy, sufferers who got XPro1595 displayed lowering biomarkers of neuroinflammation based mostly on a number of measures and assays.

With the “optimistic” information in tow and extra updates anticipated in 2H21, McCarthy thinks the shares are undervalued in comparison with friends. As an example, INmune at present has a market cap of ~$347 million in comparison with Annovis Bio, which has a market cap of ~$728 million.

“Each firms have drug improvement at comparatively related levels, and each are concentrating on the neuroinflammation cascade. As such, we see a valuation hole,” McCarthy stated. “Mixed with what we consider may very well be rising valuations round AAIC if optimistic information emerges across the area, INMB shares must be positioned to rise in worth.”

Moreover, with a burn price of roughly $4 to $5 million per quarter and ~$45 million of money within the coffers, the corporate must be well-funded for the foreseeable future.

Accordingly, McCarthy charges INMB shares a Purchase, and his $42 worth goal signifies shares might soar ~77% over the subsequent 12 months.

Two different analysts have thrown the hat in with an INMB evaluate not too long ago and each are optimistic, giving this inventory a Robust Purchase consensus ranking. The forecast is for one-year upside of ~44%, given the typical worth goal clocks in at $34. (See INMB inventory evaluation on TipRanks)

Annovis Bio (ANVS)

Finishing McCarthy’s checklist of promising AD resolution seekers is Annovis Bio. As famous above, the corporate’s valuation is considerably increased than peer INmune’s. That’s right down to the large 1,455% of share positive aspects accrued already in 2021. Nevertheless, McCarthy thinks there’s nonetheless extra room to run.

Annovis’ pipeline consists of medication for Alzheimer’s illness and different neurodegenerative problems. Its lead compound is ANVS-401, indicated for Alzheimer’s illness and its orphan indication Alzheimer’s illness and dementia in Down syndrome (AD-DS) and Parkinson’s illness (PD).

ANVS-401 is exclusive in that it focuses on three totally different neurotoxic proteins within the mind, as a substitute of just one. All are correlated to Alzheimer’s, and two are linked to Parkinson’s.

Towards the top of Might, the corporate launched information from a small section 2 research, which confirmed that following 25 days of remedy, ANVS-401 improved the cognitive habits of Alzheimer’s sufferers in a statistically important method. ANVS401 was additionally proven to enhance Parkinson’s illness sufferers’ motor coordination.

McCarthy is impressed with the info up to now.

“Whereas a small N worth within the research (N=14), the info are compelling and monitor with how impacting neuroinflammation and the inflammatory cascade can probably result in enhancements or stabilization of cognition loss,” the analyst famous, including, “On the AD aspect of the trial, the cog information was already optimistic. Given this, and what the affect on biomarkers to date was in PD, we anticipate the likelihood of optimistic biomarker information in AD to favor Annovis; this represents a major catalyst for ANVS shares, in our view.”

As soon as once more, additional bolstering the bull case is Annovis’ robust stability sheet. Through latest fairness financing, Annovis raised $50 million. With the corporate burning by way of roughly $3 million 1 / 4, McCarthy believes that even because the ANVS401 applications advance and the bills pile up, Annovis ought to have “enough runway into 2023 or later.”

What this all means is a vote of confidence from McCarthy with a Purchase ranking and a $150 worth goal, suggesting room for a further 28% uptick from present ranges.

Regardless of the massive share positive aspects, Annovis has but to draw protection from different analysts and McCarthy’s is at present the one analyst evaluate on document. (See ANVS inventory evaluation on TipRanks)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally essential to do your individual evaluation earlier than making any funding.

Source link

/GettyImages-836674058-3b2cc93807d64691980e966400a24f10.jpg)