by Michael Snyder

There isn’t any query that enormous companies completely dominate our society at the moment. They management what we eat, they management what we watch on tv, they personal many of the shops that we store at, they supply the power that our nation relies upon upon, they usually make nearly all the merchandise that we use. Tens of thousands and thousands of People make a dwelling by serving these colossal companies, and at this level among the largest companies are bigger than many small international locations. However in fact the firms aren’t the highest of the meals chain. They’ve house owners, and there are 3 big monetary corporations that the worldwide elite use to manage 88 % of the firms which might be at present listed on the S&P 500.

The three monetary corporations that I’m speaking about are BlackRock, Vanguard and State Avenue.

In accordance to CNN, these corporations have a mixed 15 trillion {dollars} in mixed property underneath administration…

BlackRock, Vanguard and State Avenue handle a shocking $15 trillion in mixed property, equal to greater than three-quarters the scale of the US financial system.

However that’s truly an previous quantity.

I wished to provide you with a more recent quantity, and so I began digging.

In accordance to Wikipedia, BlackRock had $8.67 trillion in property underneath administration as of January 2021…

BlackRock, Inc. is an American multinational funding administration company based mostly in New York Metropolis. Based in 1988, initially as a danger administration and glued revenue institutional asset supervisor, BlackRock is the world’s largest asset supervisor, with $8.67 trillion in property underneath administration as of January 2021.[citation needed][6] BlackRock operates globally with 70 workplaces in 30 international locations and shoppers in 100 international locations.[7]

Vanguard is almost as large. In accordance to Wikipedia, Vanguard had $6.2 trillion in property underneath administration as of January 2021…

The Vanguard Group, Inc. is an American registered funding advisor based mostly in Malvern, Pennsylvania with about $6.2 trillion in world property underneath administration, as of January 31, 2020.[5] It’s the largest supplier of mutual funds and the second-largest supplier of exchange-traded funds (ETFs) on the planet after BlackRock’s iShares.[6] Along with mutual funds and ETFs, Vanguard presents brokerage providers, variable and glued annuities, instructional account providers, monetary planning, asset administration, and belief providers. A number of mutual funds managed by Vanguard are ranked on the high of the listing of US mutual funds by property underneath administration.[7]

Whereas not as giant as the opposite two, State Avenue had $3.1 trillion in property underneath administration as of the primary month of this yr.

So including these numbers up, the “large three” had nearly 18 trillion {dollars} in property underneath administration in January 2021, and that quantity is nearly definitely fairly a bit increased by now.

That may be a big pile of cash that’s nearly not possible to think about.

Typically individuals overlook simply how a lot cash a trillion {dollars} is. If you happen to have been alive when Jesus was born and also you spent 1,000,000 {dollars} each single day since then, you continue to wouldn’t have spent a trillion {dollars} but.

Collectively, the “large three” characterize the biggest possession blocks in 88 % of the businesses which might be at present listed on the S&P 500…

Mixed, BlackRock, State Avenue and Vanguard are the biggest proprietor in 88% of the S&P 500 corporations, in keeping with a paper printed Tuesday by the American Financial Liberties Challenge, a gaggle that launched in February taking intention at what it sees as extreme company energy. As an illustration, the Massive Three maintain main stakes in corporations together with Apple (AAPL), JPMorgan Chase (JPM) and Pfizer (PFE).

Being the biggest proprietor of a publicly traded firm doesn’t imply that you are able to do no matter you need, however it does provide you with huge energy.

For instance, final month BlackRock and Vanguard have been instrumental in putting in two new members on ExxonMobil’s board of administrators…

BlackRock and Vanguard have been among the many main shareholders whose votes helped to put in two new members on ExxonMobil’s board of administrators, dealing the oil big a significant defeat within the election of board members at this yr’s annual (digital) shareholders assembly.

The 2 fund giants, which collectively personal roughly 14% of ExxonMobil shares, in keeping with studies, supported parts of a dissident slate of board nominees introduced by a Engine No. 1, an activist, purpose-driven funding agency that sees ExxonMobil’s response to the worldwide local weather disaster as far too weak to assist obtain web zero emissions by 2050, placing shareholder worth in danger. Engine No. 1 put forth a slate of 4 nominees, all with expertise within the oil and gasoline or renewable power trade.

ExxonMobil didn’t need these new board members, however now they’ve been compelled to take them.

And these new board members will assist to make sure that ExxonMobil turns into extra absolutely aligned with the local weather agenda of the worldwide elite.

For these within the world elite, it’s a lot simpler to make use of cash and energy to enact change by means of company buildings than it’s by means of numerous governmental our bodies across the globe.

In truth, many would argue that in 2021 companies have much more of an influence on our day after day lives than any governmental entities do.

Sadly, we will’t do a lot to change how these companies behave as a result of they reply to their house owners.

At this level, one of many the explanation why it looks like so many companies have an identical tradition is as a result of so a lot of them are managed by the very same individuals on the very high.

If you don’t conform, you’re a lot much less more likely to be employed by considered one of these companies, and when you do get employed you aren’t more likely to rise very far by means of the ranks.

We have to begin speaking much more about “company tyranny”. As a result of though governmental entities should still declare to guard “liberties” and “freedoms”, the reality is that people who reject the tradition that’s being pushed on them by the worldwide elite will probably be more and more marginalized on the fringes of society.

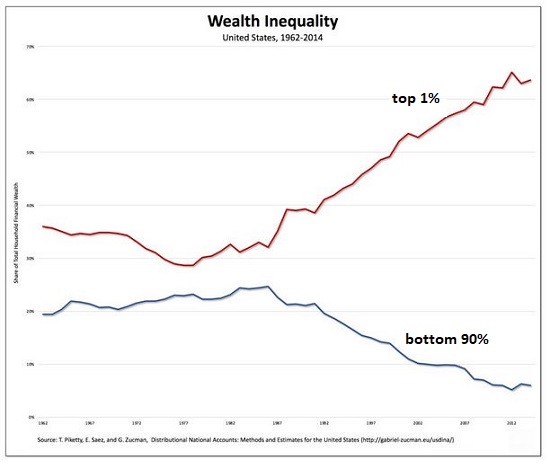

America’s founders have been very suspicious of all giant concentrations of energy. At present, wealth and energy are extra concentrated in our society than ever earlier than, and that’s not a great factor. In truth, that is an existential risk to our lifestyle, however not that many individuals are specializing in this.

And don’t count on our legislators in Washington to do something. They need to hold the marketing campaign donations flowing, and so only a few of them are ever fascinated about confronting the massive cash pursuits on Wall Avenue.

389 views

Source link