Say ‘inexperienced economic system,’ and what’s the very first thing you consider? Renewable fuels, electrical automobiles, solar energy farms, wind generators, hydrogen gasoline cells, recycling vegetation – these are all elements of the inexperienced economic system. The financial sector is at present small, in comparison with the US’ near-$20 trillion annual financial output, but it surely’s politically potent and gaining in significance 12 months by 12 months. And as they develop, inexperienced industries carry increasingly alternatives to traders.

These alternatives, nonetheless, aren’t at all times clear. Inexperienced tech firms function in new niches, or carry new twists to outdated niches, making them troublesome, at instances, for retail traders to judge. However for traders prepared to place within the legwork, there are many inexperienced firms on the market, within the small- to mid-cap vary, to select from.

We’ve used the TipRanks platform to lookup the latest stats on two firms which might be a part of the renewable power sector. They strategy the overall drawback – producing clear power from renewable sources – from very totally different path, however past that, they match a profile. They’re Purchase-rated shares, with appreciable upside potential. Let’s take a better look.

TPI Composites (TPIC)

The primary inventory we’re taking a look at, TPI Composites, develops and manufactures light-weight, high-strength composite supplies – supplies that are utilized in wind generators. TPI is a worldwide chief within the manufacturing of composite wind turbine blades, holding a 32% international market share, excluding China. The corporate noticed $1.7 billion in web gross sales in 2020, for a corporation report.

With international electrical energy demand anticipated to develop by 60% over the following 30 years, and wind energy making up an rising share of that enlargement, TPI’s alternative is obvious.

A have a look at the corporate’s 1Q21 numbers will present that it’s already grabbing that chance. TPIC reported $404 million in complete gross sales for the quarter, up from $356 within the prior Q1, or 13.5%. A number of key efficiency indicators all rose throughout the quarter – the entire variety of blade units produced rose yoy, from 731 to 814; the estimated megawattage of generated power from these blade units improve yoy from 2,329 to three,072; and the utilization charge, a comparability of the blades invoiced to the blades produced, rose from 70% to 77%, a sign that the turbine blades are going to energetic wind energy farms.

On the destructive aspect of the ledger, the corporate’s web loss deepened from 1 cent per share a 12 months in the past to five cents within the latest Q1. On the similar time, Q1’s administrative prices fell, dropping from $9.5 million to $8.9 million.

Weighing in from Evercore ISI, analyst James West is closely impressed by this firm’s manufacturing efficiency, particularly given the pandemic disaster.

“Impressively all of TPIC’s international wind manufacturing amenities are working usually. We had been involved spikes in new COVID-19 circumstances may disrupt exercise on the new India plant, however the influence has been immaterial to operations or the availability chain in India or Turkey the place circumstances additionally elevated in latest months. Manufacturing can also be regular in China the place TPIC is working to backfill 5 strains taken out of manufacturing late final 12 months,” West wrote.

To this finish, West places an Outperform (i.e. Purchase) score on TPIC inventory, and units a $65 value goal that suggests a 41% one-year upside potential (To observe West’s observe report, click on right here)

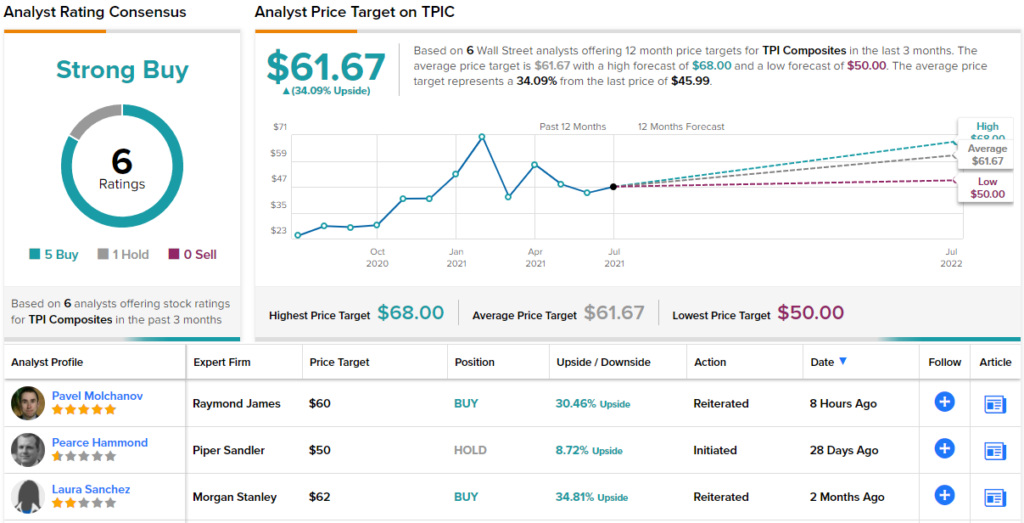

Total, TPIC has a Sturdy Purchase consensus score, primarily based on 6 evaluations that embrace 5 Buys and simply 1 Maintain. The shares are priced at $45.99 and their $61.67 common value goal suggests room for 34% upside within the subsequent 12 months. (See TPIC inventory evaluation on TipRanks)

American Superconductor (AMSC)

For the following inventory, we’ll flip to American Superconductor, an organization that works to combine the inexperienced energy technology sector into present electrical grids. Inexperienced electrical energy, primarily generated by wind or photo voltaic amenities, could be extremely variable in complete output and voltage; AMSC develops management techniques that may be stalled on the energy substations and even on particular person wind generators, and which then help the connections between energy technology sources and the grid.

Connecting inexperienced energy to the grid is simply a part of this firm’s work, nonetheless. American Superconductor has an energetic marine division, creating effectivity enhancements, together with degaussing gadgets, for marine-use electrical motors. The corporate additionally has a wind tech division, concerned in wind energy technology, designing onshore and offshore wind generators.

Within the first half of this 12 months, American Superconductor has been increasing its enterprise. In January, AMSC contracted with the US Navy to deploy a excessive temperature conductor (HTS)-based ship safety system on the following San Antonio class amphibious transport. This would be the fourth such system AMSC has put in on a San Antonio ship. Extra not too long ago, in June, AMSC introduced greater than $19 million in new orders for power energy techniques, within the US and overseas.

Additionally in June, AMSC launched its monetary outcomes for This autumn of fiscal 2020. The highest line income got here in at $21.2 million, up 16% from the $18.1 million reported within the year-ago quarter. Whereas income was up, the EPS loss deepened barely yoy, from 27 cents to 29 cents. In two key metrics, the corporate reported sturdy progress – the grid enterprise, the corporate’s core, grew 40% in fiscal 12 months 2020, the sixth 12 months in a row of progress, whereas AMSC completed fiscal This autumn with over $80 million in money available, up 21% yoy.

Oppenheimer’s analyst Colin Rusch, rated 5 stars and holding the #6 place total in TipRanks’ rankings, is impressed by AMSC and writes: “We’re inspired by the corporate’s potential to achieve constructive money move from a number of routes, together with progress in Gridtec, incremental Navy orders, and a restoration within the Wind enterprise…. We stay bullish as we imagine energy high quality and administration will show essential for the rising net-zero economic system…”

The analyst added, “We imagine AMSC has constructed a portfolio of value-added IP and is positioned to profit in each its Windtec and Gridtec companies from long-term secular traits, together with ageing utility infrastructure and the proliferation of intermittent renewable power technology.”

According to these feedback, Rusch offers the inventory an Outperform (i.e. Purchase) score, with a $28 value goal to suggest a 74% one-year upside potential. (To observe Rusch’s observe report, click on right here)

Some shares fly underneath the radar, and AMSC is a kind of. Rusch’s is the one latest analyst assessment of this firm, and it’s decidedly constructive. (See AMSC inventory evaluation on TipRanks)

To seek out good concepts for clear power shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally necessary to do your individual evaluation earlier than making any funding.

Source link