Bitcoin (BTC) costs broke under a long-standing help wave that was instrumental in maintaining its sturdy bullish bias intact after March 2020’s crypto market crash.

Dubbed the 50-week easy shifting common, or 50-week SMA, the wave represents the typical value merchants have paid for Bitcoin over the previous 50 weeks. Over time, and in 2020, its invalidation as value ground has contributed to pushing the Bitcoin market into extreme bearish cycles.

For example, the 50-week SMA acted as help throughout the 2018 bear market. The wave helped forestall Bitcoin from present process deeper downtrends — between February 2018 and Might 2018 — as its value corrected from the then-record excessive of $20,000.

Equally, the wave supplied Bitcoin with unimaginable help throughout its correction from its $15,000 excessive in 2019. Furthermore, it held properly as a value ground till March 2020, when the arrival of the COVID-19 pandemic precipitated a worldwide market crash.

Fractal targets $12,000 to $13,0

Pseudonymous chartist “Bitcoin Grasp” shared considerations about Bitcoin’s potential to endure an 80% common value decline upon breaking bearish on its 50-day SMA. The analyst famous that if the stated fractal performs out, BTC/USD trade charges may crash to as little as $13,000.

#Bitcoin simply tagged the 50-week easy shifting common, let’s have a look at if the coin does not break custom of bouncing at the least 50% ($47k) from it earlier than making the same old 80% decline ($13k) from ATH.

— Bitcoin Grasp (@drei4u) July 14, 2021

#bitcoin dropping after the weekly candle opened under the construction I’ve been looking forward to a number of weeks now.

I count on a bounce between $24k - $29k largely because of the CME hole at $24615.

After that, my guess at a bear market backside can be $12k give or take $2k both facet. pic.twitter.com/aMi2M45bmf

— Keith Wareing (@officiallykeith) July 19, 2021

In the meantime, Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, additionally highlighted the 50-week SMA in a tweet earlier in July, albeit recalling the wave’s skill to withhold promoting strain. The analyst advisable that buyers mustn’t dump their Bitcoin holdings immediately on preliminary dips under the wave.

“Promoting Bitcoin on preliminary dips under its 50-week shifting common up to now has confirmed a great way to lose cash, even in bear markets,” McGlone defined.

Bitcoin market analysts have blended ideas

The newest Bitcoin dip got here within the wake of a worldwide risk-on market decline pushed by fears that the extremely transmissible Delta variant of COVID-19 would decelerate the restoration generated by the reopening of economies.

Vijay Ayyar, head of enterprise improvement at cryptocurrency trade Luno, famous that Bitcoin may drop additional. In feedback to Bloomberg, the previous Google government stated the BTC/USD trade charges may fall to as little as $20,000. Nonetheless, he anticipated the pair to retest $40,000 on the subsequent bounce.

“We’re going to wish to kind one other base first earlier than resuming one other bull pattern,” Ayyar famous.

“We’re going to be ranging between $20,000 and $40,000 for the remainder of the yr.”

Jehan Chu, the founding father of cryptocurrency-focused enterprise capital and buying and selling agency Kenetic Capital, positioned a secure draw back goal close to $25,000 however warned about accelerated sell-offs ought to bulls fail to log a rebound from the extent. He stated:

“Q1′s crypto market momentum has stalled and is threatening additional reversal probably under the $25K ranges.”

Robust fundamentals and bullish alerts stay

Nonetheless, one other analyst provided a distinct, extra optimistic perspective on the present place of Bitcoin.

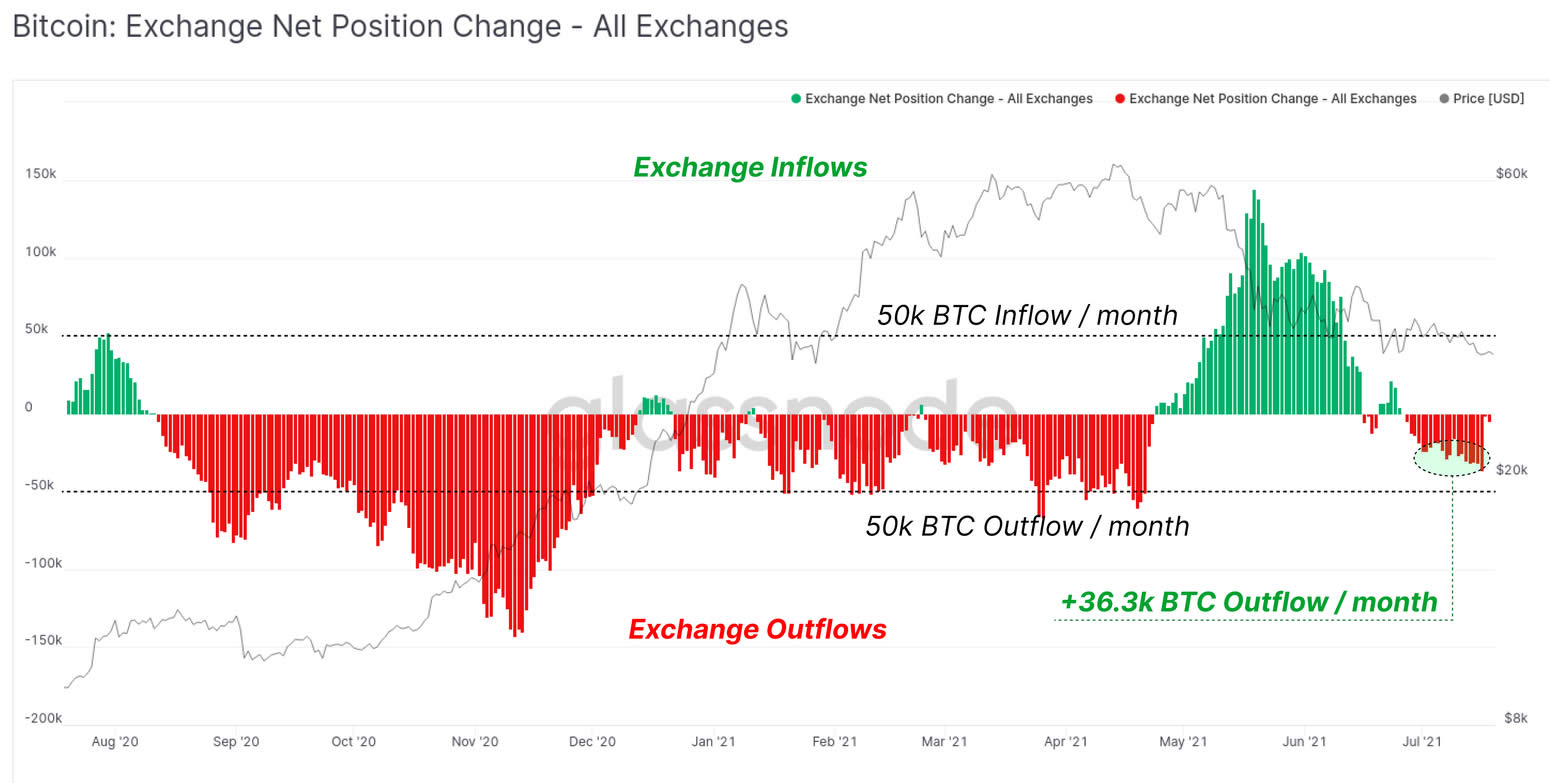

James Wo, founder CEO of the worldwide crypto funding agency Digital Finance Group, highlighted on-chain indicators, together with an ongoing decline in trade inflows and energetic pockets addresses, as a motive to remain bullish on Bitcoin.

” these on-chain indicators, we are able to say that almost all of buyers are ready for main alerts to enter the market once more,” Wo informed Cointelegraph.

Associated: Bitcoin bull outlines 7 steps to extra fiscal stimulus and better BTC costs

Knowledge supplied by CryptoQuant, a South Korea-based blockchain analytics agency, additionally supplied a bullish setup for Bitcoin, citing the cryptocurrency’s market-value-to-realized-value (MVRV) ratio.

Intimately, the MVRV ratio represents an asset’s market capitalization divided by realized capitalization. When the determine is just too excessive, merchants could interpret Bitcoin’s value as being overvalued, thereby implying promoting strain. However, when the MVRV worth is just too low, merchants could deal with Bitcoin costs as undervalued, implying shopping for strain.

“Shopping for [Bitcoin] at this identical stage up to now cycle was seen between January to March 2017,” famous one of many CryptoQuant analysts, including:

“It doesn’t promote on the backside however prepares ammunition for the underside. Brief-term knowledge supply the chance of take a look at at help, good publicity alternative.”

The views and opinions expressed listed here are solely these of the writer and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer includes threat, and you need to conduct your personal analysis when making a call.

Source link